The man in the photo above has more impact today, on the world, the election, the global economy, than probably any single one person living, and I’m willing to bet most people couldn’t name him if they tried.

Give up?

That’s John Meynard Keynes. His economic model forms the basis of the modern economy and economic policy. Not since Adam Smith wrote “The Wealth of Nations” had a singular person had more of an impact on capitalism, describing its forces and how governments could best handle fluctuations. If Karl Marx and Josef Engels presented a 2-dimensional picture of the economic system of the 1800s and why and how it should collapse, Keynes presented a 3-dimensional portrait of the actual factors at play and re-affirmed capitalism’s superiority. Every President and Economist since has followed the Keynesian Economic Model and even noted conservative economist Milton Friedman noted to President Richard Nixon in the early ‘70s, “We are all Keynesians now.” During the global economic collapse of 2008, Keynesian economics took on new vitality as most countries used Keynesian methods to try and turn the tide and get the economy moving positive again.

As I look online more and more, I see many young (and some not so young) posters on social media advocate for policies that would make Keynes cringe. Mostly, they are policies that are popular with a particular group, populistic in nature, and are in practice counterproductive to the goals they seek to achieve. They don’t understand these policies’ impacts on costs, inflation, profit and a whole host of other potential calamities. They REALLY don’t understand the concept of “moral hazard” which has a huge role as well. In light of all of this, I thought it would be important to discuss Keynes today, and what he means to economics generally.

So what did Keynes suggest that was so revolutionary? It all begins with basic supply and demand.

Keynes Economics, Abbreviated.

When Keynes came onto the scene, the standard operating procedure for economists was to promote “laissez-faire capitalism.” What does that mean? It means government should stay completely outside of the economy and the economy would sort it out entirely on its own, through the miraculous invisible hand of supply and demand. And for the most part, it typically does; however this also leads to some really adverse outcomes, particularly in periods when the economy goes into a recession or bust. It meant desperate people would take jobs offering practically nothing just to put food on the table for their families, or work 80 hours a week in a bakery because the alternative was starvation.1

So when the economy ran into a speed bump and hit a recession, the general advice given was for government to do nothing, that it would fix itself eventually. Such cycles provided economic opportunities that entrepreneurs would have incentive to pursue.2 Fast-forward to the stock market collapse of 1929 and the Great Depression, and advice like that fell on deaf ears. Camps of homeless people called “Hoovervilles” after President Herbert Hoover’s lack of a response popped up everywhere. In this environment, Keynes stepped up and said that in fact there WERE things government could do to help right the economy.

Keynes accurately depicted the cratered economy as a problem with demand; nobody had jobs, therefore nobody had money to spend and thus demand was non-existent. To address this concern, he promoted ideas that would improve demand and how government could initiate that role. He advocated for public works projects that government could invest in and cutting taxes to stimulate spending. What Keynesian economics became associated with was the idea that optimal macroeconomic performance can be achieved, and slumps minimized, by government intervention with aggregate demand.

The counterargument went that if government inserted itself like this into the economy, that would only spur inflation, detrimentally impacting the economy. Nonsense, Keynes exclaimed. He demonstrated that the economy, particularly at times of mass-unemployment would not spur inflation since the initial impact would be on improving supply until the economy was working optimally. Only after supply was maximized would inflation begin to impact the economy. Therefore, Keynes also remarked how unemployment and inflation were on opposite sides of the same spectrum, and that once inflation started to rear it’s head, it would be government’s job to lower stimulus, and decrease spending, cooling off the economy.

So Why are We Talking About Keynes Now?

We’ve been at less than 4% unemployment for the longest stretch in America since the 1960s. Right now, the main economic fear is of inflation, which peaked immediately after COVID and has stubbornly hung around, despite decreasing to more manageable levels. Nonetheless, the more government stimulus into the economy, the more likely inflation increases.

Ask any Gen Zer what their biggest issue is and most everyone under the age of 30 would have student loan debt forgiveness as one of them.

Putting aside the argument for now about moral hazard,3 what impact does student debt loan forgiveness have on the overall economy. It’s remarkably stimulative.

It targets the middle to upper middle class primarily, as it is those kind of jobs college graduates tend to get.

It frees up money that would be spent on debt, and instead re-injects it into the economy on discretionary items.

It encourages job shopping, as people are less bound to remain in the same job in order to pay debts. Normally, this would be a good thing, but it also encourages companies to raise wages to attract top talent, further fueling inflation.

But you know what it doesn’t do? Help people on the lower end of the economic ladder.

Low income individuals typically don’t have college loan debt. They didn’t go to college.

Increasing inflation detrimentally impacts lower income individuals the most.

Debt forgiveness is essentially taking tax dollars to make it easy for people who are in line to be pretty well off to get off without consequence. Those that chose to do the right thing and not go to college they couldn’t afford, are detrimentally impacted.4

Economically, at this point in time, student loan debt forgiveness makes no sense. It has no beneficial impact on the economy, at all. That’s not to say it would never be a good idea. In fact, at one point, I thought it made particularly great sense. When was that? 2008 during the Housing crisis:

Student debt forgiveness would’ve freed up individuals to pay their mortgages instead of going into foreclosure, which foreclosure further dragged down the economy.

It would curb deflationary pressures on home values as people spent money on their mortgages.

It would free up more student loan money at a time that it made sense for people to go back to school to further their degrees.

The cost of student loan forgiveness as a stimulus for the economy would’ve been cheaper and more immediate than many of the choices Bush and Obama opted for.

The people most directly impacted were middle income homeowners who’s home values collapsed. Student debt forgiveness would’ve helped this cohort stem the bleeding. They could make ends meet and still contribute to the economy by spending. One of the reasons for the long malaise afterwards was banks’ strategy of sitting on the money refusing to lend it out, reducing economic stimulus.

It made a helluva lot more sense than giving it directly to banks who had no incentive to lend it back out. Placing money back in the hands of people who would spend it, either on the market or on their home mortgages would cascade through the economy.

In any event, Gen Z needs to better understand economic impacts and what various policies mean on the economy. I’d like to see less opinions like this one.

Good luck with all that, OfCletus.

PurpleAmerica’s Cultural Corner

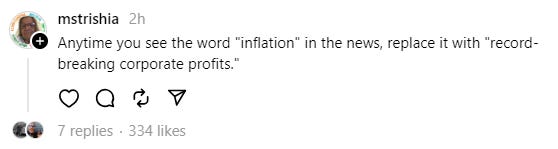

I see a lot of cracks like this online:

It really stems from a lack of understanding of what drives higher prices. Namely demand. If people stopped paying when prices went up (demand decreases), prices would come down. Since people, especially young people, don’t change their spending habits, prices continue to rise. Gen Z still doesn’t grasp this simple concept.

Billionaires make great villains. They’re as stereotypically evil as it gets— every Bond villain was wealthy beyond belief. There has always been a divide of class envy in the world and the great divide between the rich and not so rich always serves as a huge chasm that is largely uncrossable. It’s exceptionally easy to hate on Jeff Bezos, Richard Branson and Elon Musk for their extremely expensive space boondoggles. Seeing a Bitcoin Billionaire go to jail for fraud makes us all smirk with glee and schadenfraude. I mean, who DOESNT like that? Nobody really deserves a billion dollars, but capitalism with all of its attributes does occassionally result in some perverse outcomes from time to time.

There are exceptions though, when we see people start from practically nothing to build something unqiue and prosper, or when they are particularly philanthropic. Then we kind of like them a little, even aspire a little bit.

Take Taylor Swift for instance. Exceptionally talented. Worked hard since her teens. Probably the most sought after ticket in the world. Whether she “deserves” or “earned” a billion is a question of value and not of merit, but most would probably look at her and say “All right, I’m OK with her being a billionaire.” She’s also been pretty generous with those that help her out too.

Bill Gates even made it a point that the tax code is extremely unfair based on his own net worth. He’s made it a point to argue that he should be taxed more and that the government should be less lenient with high income earners like himself. In a 60 Minutes interview one time, it was noted he had the highest tax bill one year, and he replied that it should have been more.

Bill and Melinda Gates, along with Warren Buffett have taken a pledge and encouraged other billionaires to donate their wealth to worthy causes, and not to pass it down to their children as inherited wealth. Buffett bought Dairy Queen because he remembered what fun it was as a kid to go there and wanted to pass that feeling to his grandkids. He also still lives in the first house he bought with his wife, way back before he became a millionaire.

One person, who has also taken that pledge, and who seems to be having a wonderful time doing it, is McKenzie Scott, Jeff Bezos’s ex-wife.

Now Scott got most of her money through her divorce with Jeff Bezos, who at the time was the world’s wealthiest individual.5 Upon her divorce she has been gleefully spending much of her wealth, distributing across hundreds of non-profit organizations. Recently, she just gave away $640 million.

So yeah, billionaires can be completely awful people sometimes. But sometimes, especially those that did not grow up in wealth but instead rose from small incomes to huge paydays, they do a lot of good in the world.

PurpleAmerica’s Obscure Fact of the Day

In one very important respect, inflation can be a good thing.

You see, rising prices eventually leads to wage inflation, people making more to maintain the cost of living.

That’s why long term loans such as mortgages and consolidated student loan debt are positive ways to build good credit. Yes, they take a lot of time to pay off, but that $50k a year you make now, not only will you be making more in the future as you rise in your career, but the amount of money you make will be increased through wage inflation as well, and the cost of the house or student loan 30 years ago won’t seem as much as it is today.

So all you people talking about how cheap it was for Gen X or Boomers to pay for a house 30 to 50 years ago, that was a comparable cost in that day and age for the wages being earned, and indicative of how much more people are making now as opposed to what was the standard wages back then.

PurpleAmerica’s Final Word on the Subject

Of course, we’re giving it to Keynes.

LIKE WHAT YOU SEE? MAKE SURE TO SUBSCRIBE AND SHARE!!!

Footnotes and Fun Stuff

This was the fact pattern for one of the major cases of the time, Lochner v. New York. THe Supreme Court shot down a law that capped hours for bakers at 60 hrs per week because it conflicted with “economic due process,” and the baker’s right to contract. It’s because of outcomes like this that the era was called “the Gilded age” or in legal circles, “the Lochner era.”

Nevermind that the only entrpreneurs with capital in such situations were already wealthy.

“Moral Hazard” is the economic concept that if you take risks and never face consequences for them, it is just an incentive to take riskier positions. Moral hazard is universally invoked whenever the government intends to bailout or pay off a private debt of some kind.

Moral hazard writ large.

There was no pre-nuptual agreement.

I think you’re missing out on a broader point: Sure, forgiveness is the worst policy option. But student loans are also the shittiest possible education financing model. The whole sector should be abolished and burned with fire.

The problem with student loan forgiveness is that it lets the banks and colleges keep on their destructive path. When the government changed the student loan laws (under Obama) with the banks/SallieMae, the colleges saw an opportunity to financially rape parents and kids by exorbitantly raising costs. Add to the fact that Arne Duncan was touting that RTtT (and all the Common Core/standardized testing garbage) would mean that EVERY child NEEDED to go to college to succeed. College and Career Ready was the mantra that parents were fed.....and boy did parents eat it up! No amount of student debt forgiveness will make a difference until the larger policies are changed/amended.

Oh, and Bill Gates and many of the other billionnaires are nothing but faux-lanthropists. They "give" their money with strings attached and that is NOT philanthropy based on altruism.