Everytime I think about Bitcoin, I think back to a Black Friday back in the late 1990s. This was at the height of the “Beanie Baby” stuffed animal craze. As I did every year, I went out on Black Friday1 and at one particular Target store, I saw the Beanie Baby phenomenon first hand. A poor store worker was pulling out a CRATE of the from the back room, and when he opened up the box that was on top he was mauled by a bunch of middle to older aged women craving collectibles. 2

Now, you may not see the connection between Bitcoin and Beanie Babies, but I do. Beanie Babies were a fad that took off. I don’t know why this particular one took off but it did, much like Cabbage Patch Kids, American Girl Dolls, or even tulip bulbs in mid 1600s Holland.3 For whatever reason, a financial craze hits the market and results in a bubble, driving up the cost. People are willing to pay a premium of these things, in order to obtain them; they buy extras in a form of speculation as the price increases as demand rises and supply dwindles. Eventually, supply catches up with demand, the price plummets and people are left holding large inventories of items they don’t want. This is what happened with Beanie Babies. What people saw as collectibles were for awhile, but when people stopped buying them the market collapsed and now you can get them on Ebay for pennies.

Bitcoin, and all cryptocurrencies generally, are financial fads. It’s claimed that it is a currency, or a medium of exchange. In that it kind of is, only in that there are some people willing to accept Bitcoin in exchange for some goods or services. But people trade items all the time as an exchange, such as Baseball Cards, anything given at a pawn shop, and yes, Beanie Babies. What actually makes something a currency is that it is stable, keeps its value, and is backed by some other item that people value. A greenback dollar, for instance, is backed by the Full Faith and Credit of the United States, as offered by the US Treasury and Federal Reserve,4 and so long as the U.S. keeps paying its bills to creditors, it’s considered the best currency in the world.

What is Bitcoin backed with? Computer code.

You see each “coin” is mined (instead of minted) with a computer solving a puzzle. It solves the puzzle, it gets a “coin.” If the total number of mined coins is 10,000, and there is $10,000 worth of investment into the “currency”, each coin is worth $1. Simple enough. On top of that, each trade of a bitcoin from the time it was mined until the end of days is logged in an online ledger called a “blockchain.” If you paid for a pizza with bitcoin5, you can find that transaction on the blockchain online.

Now, all that bitcoin changing hands electronically and being documented on an online ledger somewhere in the Internet ether, along with all the bitcoin mining occuring, requires some huge computing power and a lot of electricity to fuel it.

Bitcoin farms are all over the world, including Iceland (done to keep cooling costs down—that much computing heats up fast) and Washington State (cheapest energy costs in the country). The largest bitcoin operation is in Dalian, China, mining 750 bitcoin a month (3% of all bitcoin) at a monthly energy cost of $1,170,000. 750 Bitcoins is currently worth $21.5 million total. So its lucrative, if also envirornmentally unsound.

Which gets into the value of a bitcoin. So long as people purchase bitcoin (for trade or for investment) the value will be stable and even increase in value. It’s supposedly a hedge against inflation as well. But where and when do people invest in bitcoin? So far, its been 1) when the local regional currency collapses, as in El Salvador, Argentina and some African countries, 2) during COVID when people received government backed checks but with everything closed nothing to spend it on, so they decided to speculate, and 3) when traveling abroad to circumvent cash import laws.

Which brings up another point; many people using bitcoin are doing so to hide illicit activities. Since the ledger is somewhat anonymous, using bitcoin transactions hides who purchased things. The online marketplace “Silk Road” which trafficked drugs, prostitution and a slew of other criminal activity grew with the rise of bitcoin. But here’s the catch; authorities have gotten better at tracking criminals through their online wallets storing bitcoin and other cryptocurrencies. Since every transaction is accessible through the blockchain, everything a criminal does is kept for authorities to scrutinize which makes one wonder why anyone would use bitcoin for an illicit transaction.

Alas, at some point, people will realize the value of bitcoin is propped up by nothing but illusion, and that all they really have is computer code and someone’s word that it has value, much like those Beanie Babies. The price will collapse and fortunes will be wiped out. We are already starting to see this with people praised as financial wunderkinds, like Sam Bankman Fried, CEO and founder of crypto exchange FTX, being arrested, and charged with fraud after his firm collapsed under a paper trail demonstrating a shell game and false finances.

At least all those grannies still have stuffed animals to keep them happy. Bitcoin bros will have nothing but computer code.

PurpleAmerica’s Recommended Stories

You may remember actor Ben McKenzie from shows like “The O.C.” and “Gotham.” However, he also has an undergraduate degree in Economics, and has been an outspoken critic of cryptocurrencies and NFTs. His new book is worth your attention.

https://www.amazon.com/Easy-Money-Cryptocurrency-Casino-Capitalism/dp/1419766392

For those who want to read about the RISE of Bitcoin, there is Ben Mezrich’s phenomenal book about The Winklevosses and their role in poplularizing Bitcoin. It’s a fascinating read about how it started as a libertarian idea and how the Winklevosses worked to legitimize it.

https://www.amazon.com/Bitcoin-Billionaires-Ben-Mezrich-audiobook/dp/B07K4RLXDT/ref=sr_1_1?crid=3RM69C6P2RDPY&keywords=bitcoin+billionaires+by+ben+mezrich&qid=1683049642&s=books&sprefix=Bitcoin+Billion%2Cstripbooks%2C111&sr=1-1

My last book recommendation is “American Kingpin” about Ross Ulbrecht, the founder and mastermind of the online marketplace “Silk Road, which trafficked in all sorts of criminal enterprises. The rise of Silk Road was facilitated with the rise of bitcoin.

https://www.amazon.com/American-Kingpin-Criminal-Mastermind-Behind/dp/1591848148

PurpleAmerica’s Obscure Fact of the Day

The value of things is always related to what someone is willing to pay for an item. Below are a few quick hits on collectibles and what people are willing to pay for them:

Surprisingly, some beanie babies do still have some value among collectors. This has more to do with the uniqueness and rarity among the groups of collectors still out there. Here is a video documenting the 10 most expensive Beanie Babies to this day:

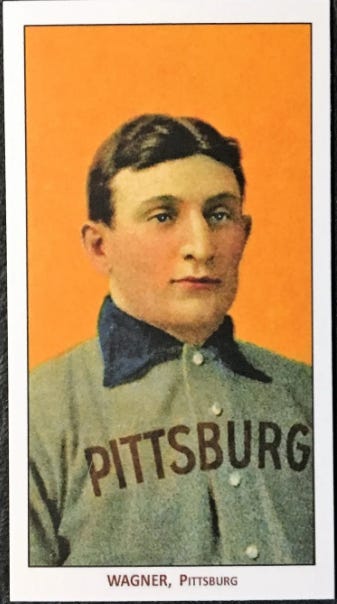

Baseball cards are another item that collectors are willing to pay premium for. The most valuable? A 1909 Honus Wagner Baseball card. If it is in mint condition, it can be worth up to $8 million. The reason is its rarity; Wagner was religious and objected to tobacco companies selling cards with his likeness, which was how baseball cards were distributed back then.

Lastly, there is a rare vintage June 1938 Action Comics #1 selling on Ebay for $15,000. Why is this collectible? It features the first instance of Superman in comics.

PurpleAmerica Cultural Criticism Corner

John Oliver had a couple of outstanding pieces on cryptocurrencies that pretty much summed the whole thing up:

Outstanding Tweet

Looking at Bitcoin Bros pump up cryptocurrencies on Twitter is a riot. I saw this last year too as the value of Bitcoin plummeted 50%. All they do is pump it in ridiculous absurd memes.

So I want to encourage you all to just search on Twitter for “bitcoin” and look at the stupidity. All in all, it can be summed up like this (even though the person who posted it seemed to think it was a plus).

Footnotes and Parting Thoughts

Let me know what you think of the page. Please share and comment!

For all the shoppers out there that are afraid of Black Friday shopping, I beg to differ. Stores give outrageous discounts on items, especially early in the morning, to get you into the stores. So many people are usually frightened off by horror stories that its not as bad as you think. I’ve gone Black Friday shopping at the Mall of America several times, and usually have all my Christmas shopping done by noon.

The funniest thing I have ever seen in my life was a woman who had to be in her late 70s tackling another over a Beanie Baby claiming the woman had stolen it.

Tulip bulb mania is one of the most fascinating bubbles in economic history. You can read more about it here. https://www.investopedia.com/terms/d/dutch_tulip_bulb_market_bubble.asp

You may note that on every dollar bill it states it is a “Federal Reserve Note.”

In fact, the first transaction made with bitcoin was for a pizza. In May 2010, California student Jeremy Sturdivant, then 19, noticed a bizarre request on a cryptocurrency internet forum: He could receive 10,000 bitcoins, at the time reportedly valued at $41, in exchange for the delivery of two large pizzas to Florida resident Laszlo Hanyecz, 28. Sturdivant filled the order, sending him two large pizzas (cheese and “supreme”) from Papa John’s — a transaction that would become the first physical purchase made with bitcoin in history, marked by the annual Bitcoin Pizza Day on May 22. But Sturdivant didn’t save the bitcoins for the future; instead, he spent them all on travel. In May 2021 that lowly 10,000 bitcoin haul would have been worth a pie-in-the-sky $365 million.